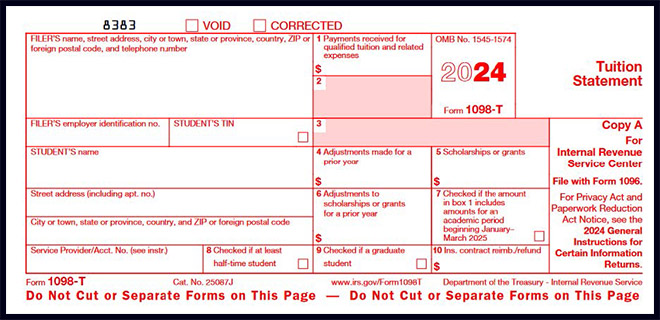

1098-T Form

South Texas College has 1098-Ts available through JagNet.

Printing Steps

- Log in to JagNet.

- On the left-side menu bar, click $ Student Accounts.

- Click 1098-Tunder Payment and Account Information.

- Enter Tax Year (example: 2025) and click Submit and Print.

Advantages of an Electronic 1098-T

- Immediate printing as soon as it becomes available.

- No waiting for regular mail or risk of lost mail.

Steps to Opt-In/Out to receive your 1098-T electronically

- Once logged into JagNet, a pop-up may automatically appear, allowing you to opt in to receive your 1098-T electronically.

- To opt out of receiving a 1098-T in electronic format, a student may withdraw consent by submitting a written request to the Cashiers Office at South Texas College.

STC cannot give legal, tax or accounting advice or determine if students qualify for a tax credit or deduction. Consult your tax professional or the IRS Publication 970 Tax Benefits for Education.

1098-T Form FAQs

What is a 1098-T form?

All eligible educational institutions must file a 1098-T form for each qualifying student for whom a reportable transaction is made during the calendar tax year.

Why did I receive a 1098-T form? Am I eligible to claim a tax credit?

Our records show that you had eligible payments during tax year in question. STC cannot give tax advice; consult your tax professional or visit IRS publication 970, Tax Benefits for Education at: https://www.irs.gov/forms-pubs/about-publication-970.

How do I reset my JagNet password?

- Students that attended in the prior year can contact Help Desk at 956-872-2111.

- Students who are unable to reactivate their account may request assistance in person at any Cashiers Office.

When am I receiving the 1098-T form?

STC is required to make 1098-T’s available by January 31, 2026.

Why did I receive a 1098-T if I never attended classes at STC?

For 2025, Box 4 or 6 adjustments to the prior year will be reported even if no attendance in class in 2025.

Why didn't I receive a 1098-T if I was enrolled in STC? Exceptions are:

- Continuing Education students do not receive a 1098-T

- Scholarships or grants exceed or equal payments for 2025

What if a parent requests the 1098-T?

Family Educational Rights and Privacy Act (FERPA) regulations allow STC to disclose information only to the student.

1098-T Form - Tuition Statement is filed with the Internal Revenue Service by January 31, 2026.

The amounts are for the calendar year January 1 to December 31, 2024.

Explanation of Boxes:

- Box 1:Payments less reimbursements or refunds.

- Box 2:Reserved for future use.

- Box 3:Reserved for future use.

- Box 4:Payment adjustments for the prior year.

- Box 5:Scholarships and Grants received.

- Box 6:Scholarships and Grants Adjustments for prior year.

- Box 7:Checked if Box 1 includes amounts for the period January-March 2025.

- Box 8:Checked if the student was enrolled at least half-time.

- Box 9:Check if graduate student – does not apply /blank

- Box 10:Insurance contract reimbursement – does not apply/blank